Polk County Realtor-DRJ Real Estate

An Educated Buyer Has Leverage! Be Prepared Before You Start Your Home Search with These 3 Tips

Buying a home is an exciting adventure. However, it can also be intimidating and frustrating. This is especially true for first time home buyers. This can also apply to people relocating to a new area. Whether you are looking to buy a home in Polk County Florida, Lakeland, or anywhere else in the US, there are a few simple things you should do to be a prepared Buyer. Being prepared will help you with your home search and your budget while helping you get the best deal possible on your new home!

Here are the DRJ Real Estate Top-3 things we feel like every Buyer should know:

1. Know Your Credit Score

We start here because before you even start to look at houses you should know what you can afford. Knowing how much house you can afford starts with knowing your credit score. These days it is easy to keep track of your credit score without needing a “hard” inquiry.

A hard inquiry, or “hard pull” can lower your credit score. However, these hard pulls are typically only necessary when applying for financing from a financial institution or bank. For example, when you work with a lender to obtain a loan for a home, they will need to do a hard inquiry into your credit. Also, buying a car which you need a loan for would require a hard inquiry, as would applying for a credit card. Having frequent hard inquiries can lower your credit score by a few points.

Alternatively, a soft inquiry does not hurt your credit score, and is a great way to monitor your credit. A soft inquiry would be something done during a background check for a job, or when applying for “pre-approved” credit. Equifax and TransUnion are two of the three major credit bureaus. They provide you with your credit score at no charge and is only a soft inquiry. Other services like Credit Karma also provide free credit score tracking.

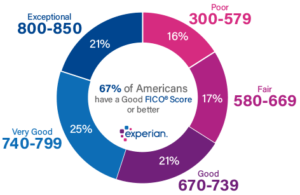

Your credit score falls into one of several categories. Once you know your score, a lender or your Realtor will have a better idea on how much a loan will cost you, and ultimately how much house you can afford.

2. Know Your Buyer’s Costs

This is another really important piece that many first time home Buyer’s don’t know about. You can think of Buyer’s costs as the out-of-pocket cash in addition to the down payment that will be needed in order to “close” on the house. This may include “points” on your loan, transaction fees, application fees, appraisal fees, title search fees, and other negotiated fees with the Seller.

According to Rocket Mortgage, closing costs average between 3%-6% of the sale price. That can be a significant amount of cash on top of a down payment for people to come up with. DRJ Real Estate always wants our Buyer’s to be well prepared which is why we make sure to help you estimate exactly what you will need in order to get into the house of your dreams. We also don’t want any unexpected charges to show up when it comes time to sign papers. Sometimes there are fees or charges that can be waived or negotiated with the Seller or Lender. As an informed Buyer, you can avoid unexpected costs.

3. Work With a Professional

The bottom line is that Buying a house can be tricky to navigate. There are many moving parts, and a lot of coordination that needs to happen. All that is in addition to making sure you are not overpaying for your loan or for closing costs, as well as presenting the strongest possible offer when you do find a home you love. Keep in mind that a strong offer is not always just about offering the listing price. There are incentives and techniques that DRJ Real Estate may use that can make your offer stand out in a competitive market.

Ultimately, it does not cost you any money as a Buyer to work with a DRJ Real Estate professional, so why would you ever go it alone? It just puts someone in your corner with skills, training, experience, and access to help you find the right house AND the right deal. We understand the Lakeland market, which means we know if a house is listed at a good price, if it has the right inspections in place, and if it is the right fit for your financial situation.

When you come into the real estate market prepared, you have leverage! This allows you to save money where you can, strengthen your offer, and avoid unwanted surprises at closing.

Want to learn our best kept Home Buying Secrets? Check out our Buyer’s Class at DRJ University!!

If you are looking to move into the beautiful Polk County Florida area, then CONTACT DRJ REAL ESTATE right now to put us to work for you! We are Polk County’s premier, full service real estate team that specializes in Polk County and Lakeland real estate.

Are you a Hero?? Ask us how we can help save you thousands of dollars as a Buyer or Seller! Savings if you are a Firefighter, LEO, Medical Professional, Teacher, Military or Veteran, or Clergy! We are a proud affiliate of Homes for Heroes.

**Like and Follow us on Facebook to keep up to date with new listings and real estate tips**